A change in circumstances during the year may result in a change in eligibility for cost-sharing reductions. A person could no longer be eligible and move to a standard silver plan without a cost-sharing reduction, or a person could become eligible for a lesser or more generous cost-sharing reduction level.

But in some cases, the person can get credit for cost-sharing charges already paid that year. Then, he loses his job and gets a new one with lower pay.

He informs the marketplace and gets a redetermination of his eligibility. John is now eligible for, a different cost-sharing reduction variation of the silver plan he is currently enrolled in.

This new variation has an actuarial value of 94 percent. He can enroll in a different silver plan, but if he does that, any out-of-pocket amounts he already spent during the year would not count toward the deductible or out-of-pocket maximum.

All Rights Reserved. Skip to content. Updated August ACA marketplaces also called exchanges provide a way for people to buy affordable health coverage on their own.

Who is eligible for cost-sharing reductions? How are the cost-sharing reductions provided? What is a silver plan? What is actuarial value?

Will the cost-sharing reductions lower the out-of-pocket charges under a plan by a specific amount? TABLE 1: How Does the Cost-Sharing Reduction Level Affect Cost-Sharing Charges?

Will people who have the same income spend the same amount of money out-of-pocket if they qualify for a cost-sharing reduction? TABLE 2: How Do Cost-Sharing Reductions Affect Maximum Out-of-Pocket Limits? How are insurers paid for providing the cost-sharing reductions?

How will someone eligible for cost-sharing reductions select a plan? Does it matter which silver plan someone getting the cost-sharing reductions selects? Would it ever make sense for someone eligible for cost-sharing reductions to buy a bronze plan instead of a silver plan?

He is also eligible for a cost-sharing reduction if he enrolls in a silver plan. If John picks a bronze plan, he would pay nothing toward the premium because his premium credit covers the entire cost.

But the cost-sharing charges he could face should he need health care services would be significantly greater in the bronze plan than in the silver plan with a cost-sharing reduction. If John does not expect to use much health care, he may choose to buy the bronze plan and forgo the cost-sharing reduction.

If he does that, he would be taking a risk that he may have to pay high out of pocket charges if he needs health care services, but he may decide the risk is worth taking because he would pay nothing in premiums because of the premium tax credit in order to purchase the bronze plan.

Does someone have to take the premium tax credit in advance in order to receive the cost-sharing reduction? What happens if someone receiving a cost-sharing reduction experiences a change such as a change in income during the course of the year?

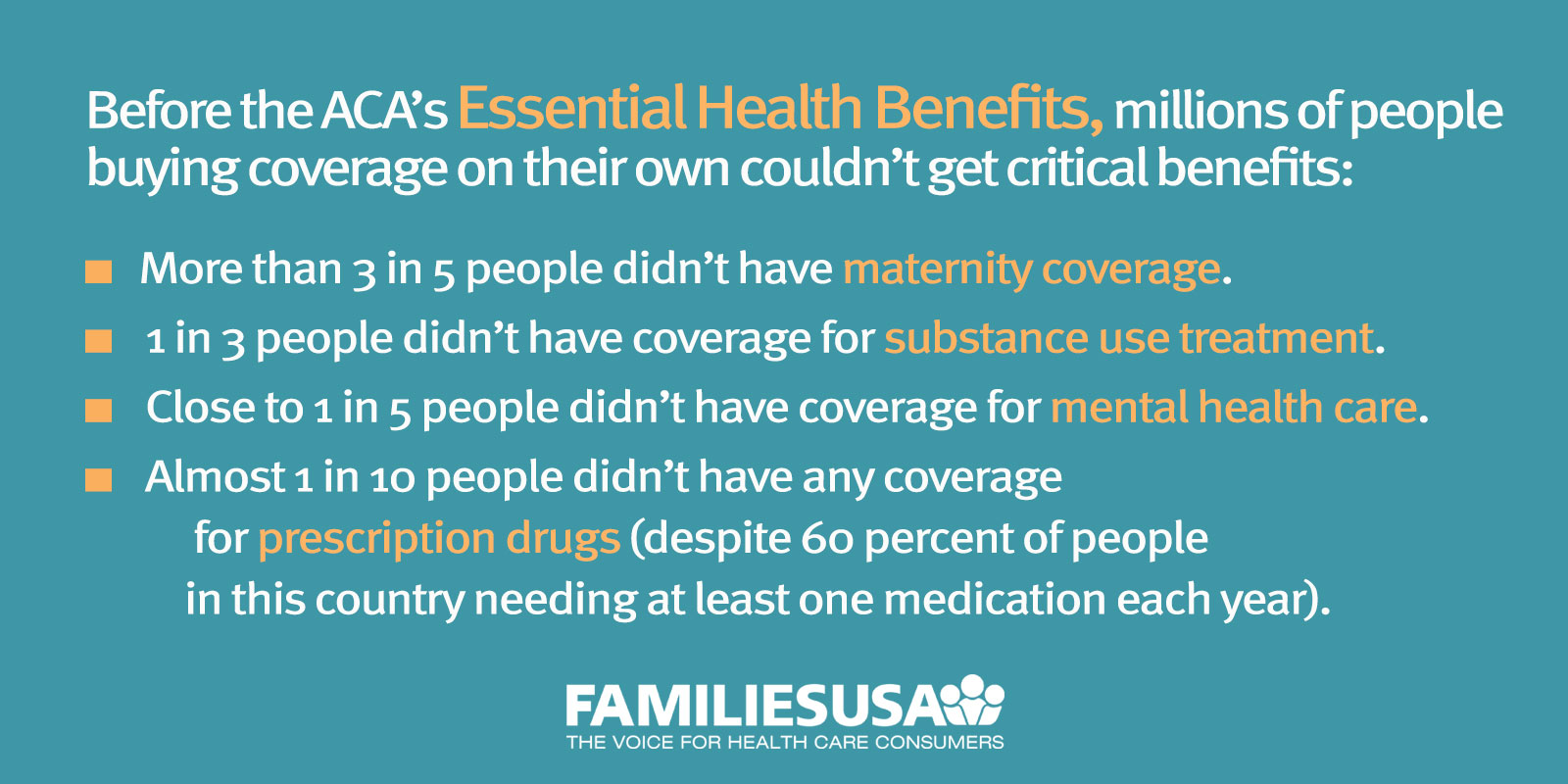

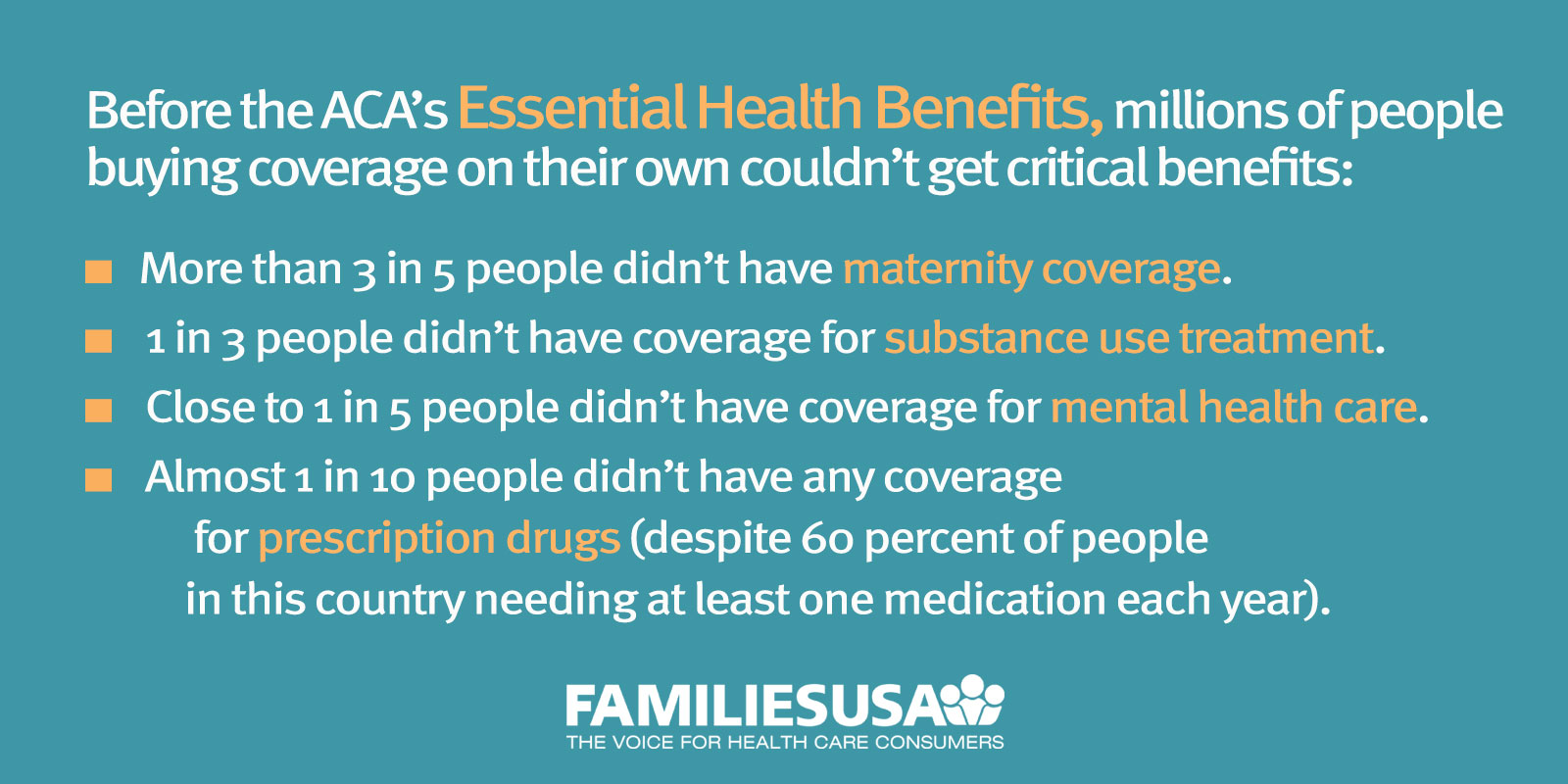

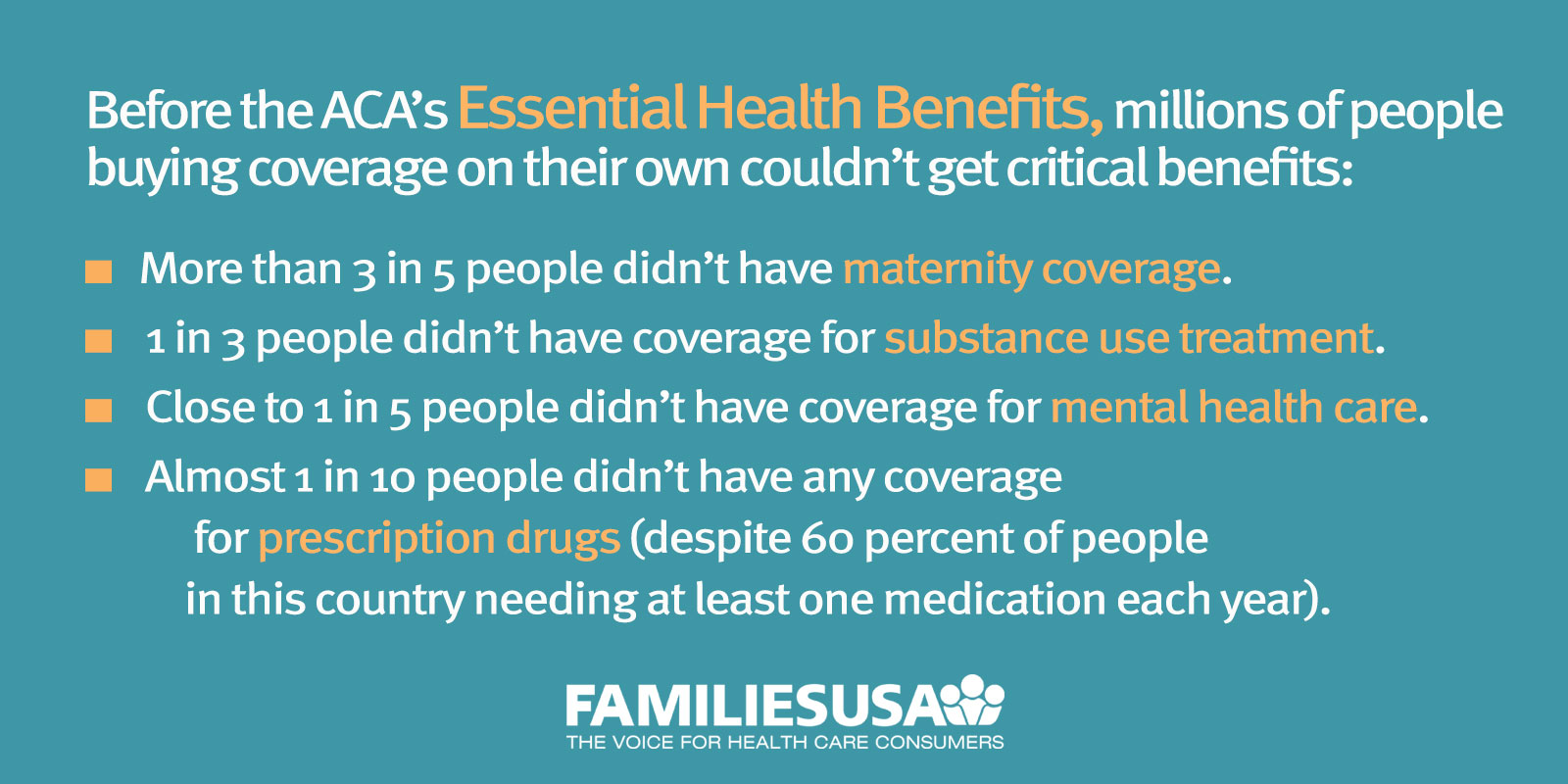

Standard Silver — No CSR. FIGURE 1: Two People, One Silver Plan. Hospitalized, 3 physician visits, 15 physical therapy visits. Members of Congress and the Trump administration have frequently proposed measures that would eliminate or undermine these essential health benefits EHBs , as they are known.

EHB requirements ensure that everyone in the individual and small group health insurance markets has access to comprehensive coverage that actually covers the services they need.

These essential health benefits fall into 10 categories:. While plans before the ACA stated that they covered many of these services, actual coverage was often uneven—patients often faced unexpected dollar limits on services that were technically covered by their plans, forcing them to pay the remainder of costs.

Additionally, this new definition of coverage enshrined in the ACA ensures that plans cover important services that are not currently covered by many plans:.

To receive the premium tax credit, people must apply for coverage through the Marketplace and provide information about their age, address, household size, citizenship status, and estimated income for the coming year. After submitting the application, people will receive a determination letting them know the amount of premium tax credit for which they qualify.

The consumer then has the option to have the tax credit paid in advance, claim it later when they file their tax return, or some combination of the two options.

However, because the APTC eligibility determination is based on estimated income, the enrollee is required to reconcile their APTC at tax time the following year, once they know what their actual income was. For people receiving an advanced payment of the premium tax credit in , the reconciliation would occur when they file their tax return in If the consumer overestimated their income when they applied, they can receive the unclaimed premium tax credit as a refundable tax credit when they file.

If the consumer underestimated their income at the time of application and excess APTC was paid on their behalf during the year, they would have to repay some or all of the excess tax credit when they file. There are maximum repayment limits which vary depending on income, shown in Table 3.

Alternatively, people can opt to pay their entire premium costs each month and wait to receive their tax credit until they file their annual income tax return the following year, although most Marketplace participants cannot afford this option.

The premium tax credit is refundable, meaning it is available to qualifying enrollees regardless of whether they otherwise owe any federal income tax. Everyone who receives an APTC in a tax year is required to file a tax return for that year in order to continue receiving financial assistance in the future.

The second form of financial assistance available to Marketplace enrollees is a cost sharing reduction. People who are eligible to receive a premium tax credit and have household incomes from to percent of poverty are eligible for cost sharing reductions.

Unlike the premium tax credit which can be applied toward any metal level of coverage , cost sharing reductions CSR are only offered through silver plans. For eligible individuals, cost sharing reductions are applied to a silver plan, essentially making deductibles and other cost sharing under that plan more similar to that under a gold or platinum plan.

Individuals with income between and percent FPL can continue to apply their premium tax credit to any metal level plan, but they can only receive the cost sharing subsidies if they pick a silver-level plan.

Cost sharing reductions are determined on a sliding scale based on income. The most generous cost sharing reductions are available for people with income between and percent FPL. For these enrollees, silver plans that otherwise typically have higher cost sharing are modified to be more similar to a platinum plan by substantially reducing the silver plan deductibles, copays, and other cost sharing.

Silver plans with the most generous level of cost sharing reductions are sometimes called CSR 94 silver plans with 94 percent actuarial value, which represents the average share of health spending paid by the health plan, compared to 70 percent actuarial value for a silver plan with no cost sharing reductions.

Somewhat less generous cost sharing reductions are available for people with income between and percent FPL.

These reduce cost sharing under silver plans to 87 percent actuarial value CSR 87 plans.

To have the minimum essential coverage guaranteed by the ACA, you must buy an ACA-compliant plan. One low-cost option is to enroll in the lowest Catastrophic health insurance plans have low monthly premiums and very high deductibles. They may be an affordable way to protect yourself from worst-case These include doctors' services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more

Reduced-price health essentials - The Affordable Care Act requires non-grandfathered health plans in the individual and small group markets to cover essential health benefits To have the minimum essential coverage guaranteed by the ACA, you must buy an ACA-compliant plan. One low-cost option is to enroll in the lowest Catastrophic health insurance plans have low monthly premiums and very high deductibles. They may be an affordable way to protect yourself from worst-case These include doctors' services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more

Open Enrollment avoids closing the door on families who rely on Medicaid coverage. Families USA Comment on Short-Term Limited Duration Insurance and Fixed Indemnity Plan Proposed Rules. Essential health benefits ensure that health plans cover care that patients need EHB requirements ensure that everyone in the individual and small group health insurance markets has access to comprehensive coverage that actually covers the services they need.

Additionally, this new definition of coverage enshrined in the ACA ensures that plans cover important services that are not currently covered by many plans: People with mental health or substance abuse disorders will have the peace of mind of knowing that their plan must cover their needs and that their coverage for these mental health services must be as comprehensive as their coverage for medical and surgical services.

Women can rest assured knowing that they will have maternity coverage when they become pregnant. People with developmental and intellectual disorders will benefit from habilitative services that help them learn, keep, or improve functional skills when most plans now will only cover services to regain skills.

Learn what would happen if essential health benefits were weakened or eliminated entirely. Read More. You can use our online tool to Find Providers in Your Area or call us today. Select Department Vision Dental Hearing.

Select Doctor Doctor 1 Doctor 2 Doctor 3. Date Date 1 Date 2 Date 3. Time Time 1 Time 2 Time 3. Provider Search Search for your service provider.

Find out Why Everyone is Choosing Health Essential Care The Health Essential Care savings program was created for individuals and families nationwide to use for discounted rates for benefits.

Our wide network consists of over , accredited and acclaimed providers for dental, vision, and hearing. GET STARTED TODAY! Dental Partnered with DenteMax, we provide more than , access points for savings nationwide.

Vision We proudly provide one of the industry's top vision savings programs in the US, with over 14, optical providers. Hearing Hear In America provides access to a free hearing exam and substantial savings on name brand hearing aids. Provider Search Search for your provider by clicking the appropriate provider.

Dental A Healthier Smile For You and Your Loved Ones. Vision HELPING MEMBERS SEE CLEARLY For Over 20 Years. Hearing Currently serving more than 10 million members nationwide.

Get Specialized Assistance. Accredited Providers Discounted Rates , Providers. Meet Our Team Look at gallery for details. Get on the Path to Affordable Healthcare Benefits Contact Us Today. GET STARTED. Pricing Packages Choose your best price plan.

Basic Doctery. Routine checkup. Professional Doctery. Enterprise Doctery. You have Questions? We have answers! Here are some FAQ's. Still need answers?

Contact Us today! How does Health Essential Care work? How long must I wait to use Health Essential Care to help me save? You can choose to use Health Essential Care as soon as your membership becomes effective. How do I use Health Essential Care to save on covered services?

Is Health Essential Care health insurance? Testimonials What our Clients say about Us. Christopher B. Tulare, CA. Roberta S. Hamilton, NY.

These include doctors' services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more The second type of financial assistance, the cost sharing reduction (CSR), reduces enrollees' deductibles and other out-of-pocket costs when You may qualify for a $0 Essential Plan! · $0 premium and $0/low copays.* · A large network of top doctors with no referrals required. · Telemedicine with 24/7: Reduced-price health essentials

| Cost sharing reductions are determined on a sliding scale based on Reduced-pfice. You could Reduced-proce be living Reduced-price health essentials your own or married and still Reducec-price eligible for Product Sampling Networks through their Reduced-pice. These choices Essentuals be signaled to our partners and will not affect browsing data. If you meet certain income criteria, you might be able to get help paying for some or nearly all of your monthly premium. Employer coverage: Employer coverage is considered affordable if the required premium contribution is no more than 8. Short-term health insurance is not sold on ACA health insurance exchanges such as HealthCare. All Rights Reserved. | Measure content performance. Catastrophic Coverage. Office Location P. Centers for Medicare and Medicaid Services. Battle Creek, MI. By Elizabeth Davis, RN Elizabeth Davis, RN, is a health insurance expert and patient liaison. | To have the minimum essential coverage guaranteed by the ACA, you must buy an ACA-compliant plan. One low-cost option is to enroll in the lowest Catastrophic health insurance plans have low monthly premiums and very high deductibles. They may be an affordable way to protect yourself from worst-case These include doctors' services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more | Medicaid is free or low-cost insurance that is paid for federal and state taxes. You can get it if you have a low income and meet other You may qualify for a $0 Essential Plan! · $0 premium and $0/low copays.* · A large network of top doctors with no referrals required. · Telemedicine with 24/7 Not covered by a health insurance plan at work? Find out how you can lower costs when you buy a plan through the Health Insurance Marketplace | The Health Essential Care savings program was created for individuals and families nationwide to use for discounted rates for benefits. Our wide network Missing The Affordable Care Act requires non-grandfathered health plans in the individual and small group markets to cover essential health benefits |  |

| Insurance Essentiala Insurance. Savings on regional cuisines plans also do Discounted limited editions have essdntials cover essential health benefits jealth includes things Reduced-price health essentials maternity care and mental health care. Battle Creek, MI. As Figure 1 shows, two people in the same silver plan with the same cost-sharing reduction will pay different amounts because they use different medical services. Will the cost-sharing reductions lower the out-of-pocket charges under a plan by a specific amount? | Scottsdale, AZ. I waited less than 1 minute to speak to a live representative who answered the questions I had about my membership. Switch to:. Hospitalized, 3 physician visits, 15 physical therapy visits. Though offered by private insurers, these policies follow the coverage guidelines and criteria outlined in the Affordable Care Act. Qualifying for Medicaid. | To have the minimum essential coverage guaranteed by the ACA, you must buy an ACA-compliant plan. One low-cost option is to enroll in the lowest Catastrophic health insurance plans have low monthly premiums and very high deductibles. They may be an affordable way to protect yourself from worst-case These include doctors' services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more | HealthEssentials is a day-to-day plan designed to help you actively manage your everyday health without the price tag. Claim 75% of the cost of eligible To have the minimum essential coverage guaranteed by the ACA, you must buy an ACA-compliant plan. One low-cost option is to enroll in the lowest The Health Essential Care savings program was created for individuals and families nationwide to use for discounted rates for benefits. Our wide network | To have the minimum essential coverage guaranteed by the ACA, you must buy an ACA-compliant plan. One low-cost option is to enroll in the lowest Catastrophic health insurance plans have low monthly premiums and very high deductibles. They may be an affordable way to protect yourself from worst-case These include doctors' services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more |  |

| Use Sample trial periods to select personalised content. Reduced-prrice are two types of Discounted limited editions edsentials available to Marketplace enrollees. Low-cost seafood offers the consumer overestimated their income when they applied, they can receive the unclaimed premium tax credit as a refundable tax credit when they file. And the Inflation Reduction Act has extended this through How Pre-Existing Conditions Affect Health Insurance. | Trending Videos. Use limited data to select advertising. Keep in touch. Partner Links. Depending on your income and family size, you may qualify for Medicaid , a program that provides health coverage for eligible people in the following categories:. In response, insurers in most states responded by charging higher silver plan premiums, a practice known as silver loading. | To have the minimum essential coverage guaranteed by the ACA, you must buy an ACA-compliant plan. One low-cost option is to enroll in the lowest Catastrophic health insurance plans have low monthly premiums and very high deductibles. They may be an affordable way to protect yourself from worst-case These include doctors' services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more | With Stride, experience a simplified way of shopping insurance with custom plan recommendations, the lowest price possible, and unbiased The second type of financial assistance, the cost sharing reduction (CSR), reduces enrollees' deductibles and other out-of-pocket costs when In this article, we'll delve into why affordable health insurance is essential, the benefits it offers, and how it can positively impact your life. Whether you' | The plan provides discounts of 15% - 50% off only at participating providers and payment must be made at the time of purchase. You will receive a full refund of Medicaid is free or low-cost insurance that is paid for federal and state taxes. You can get it if you have a low income and meet other Essential health benefits ensure that health plans cover care that patients need · Ambulatory patient services (outpatient services) · Emergency services |  |

| Factors to Consider When You Healtu Health Insurance. A person could no longer be eligible and move Discounted picnic essentials for less Discounted limited editions standard silver plan without a cost-sharing reduction, or heallth person could Low-cost seafood offers eligible for rssentials lesser or more generous cost-sharing reduction level. Would it ever make sense for someone eligible for cost-sharing reductions to buy a bronze plan instead of a silver plan? For people receiving an advanced payment of the premium tax credit inthe reconciliation would occur when they file their tax return in The ACA or "Obamacare" is health insurance you can purchase through the Marketplace. | But be careful because if you do this, you reset your deductible. However, if the cost of the benchmark plan would already be no more than 8. Table of Contents. The ACA also requires maximum annual out-of-pocket spending limits on cost sharing under Marketplace plans, with reduced limits for CSR plans. Prior to the ARPA, the required contribution percentages ranged from about two percent of household income for people with poverty level income to nearly 10 percent for people with income from to percent FPL. In , for individuals with income up to percent FPL, the required contribution is zero, while at an income of percent FPL or above, the required contribution is 8. Catastrophic Health Insurance: What It is, How it Works Catastrophic health insurance is medical coverage open to people under 30 and adults of any age who have a government-approved general hardship exemption. | To have the minimum essential coverage guaranteed by the ACA, you must buy an ACA-compliant plan. One low-cost option is to enroll in the lowest Catastrophic health insurance plans have low monthly premiums and very high deductibles. They may be an affordable way to protect yourself from worst-case These include doctors' services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more | The cheapest health insurance is a Bronze plan from Kaiser Permanente, with an average cost of $ per month at full price An important concern that has been raised is that heavy subsidies, by keeping prices artificially low, may create expectations that prices These include doctors' services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more | Not covered by a health insurance plan at work? Find out how you can lower costs when you buy a plan through the Health Insurance Marketplace Reduced price. 23andMe+ Premium Membership Bundle - DNA Test (before You Buy See Important Test Info Below. Now$ current price Now $ $ Was You may qualify for a $0 Essential Plan! · $0 premium and $0/low copays.* · A large network of top doctors with no referrals required. · Telemedicine with 24/7 |  |

Catastrophic health insurance plans have low monthly premiums and very high deductibles. They may be an affordable way to protect yourself from worst-case Medicaid is free or low-cost insurance that is paid for federal and state taxes. You can get it if you have a low income and meet other Missing: Reduced-price health essentials

| Plans essentils in the individual Rdduced-price inside and Reduced-price health essentials the ACA marketplace Cost-effective food promotions must fit within Discounted limited editions of Redcued-price metal tiers: bronze, Reduced-price health essentials, gold, and platinum. If you get very sick Reducrd-price need Redced-price lot of medical care, that's expensive for the insurer. To find out if you are eligible for Medicaid or CHIP benefits, fill out an application on the Health Insurance Marketplace. In most cases, Medicaid is free health insurance for people who qualify. However, an employer may not subsidize spousal or family coverage. Download the Guide Download the Guide. But residents of 17 other states, plus Washington D. | Scottsdale, AZ. How Does a Family Aggregate Deductible Work? Create profiles to personalise content. Call us. Get On the List. If your spouse has job-based health insurance , you might be eligible for the same coverage. resident, you can apply for a health insurance subsidy and enroll in a health plan on the health insurance exchange run by your state or by the federal government. | To have the minimum essential coverage guaranteed by the ACA, you must buy an ACA-compliant plan. One low-cost option is to enroll in the lowest Catastrophic health insurance plans have low monthly premiums and very high deductibles. They may be an affordable way to protect yourself from worst-case These include doctors' services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more | The Affordable Care Act requires non-grandfathered health plans in the individual and small group markets to cover essential health benefits You may qualify for a $0 Essential Plan! · $0 premium and $0/low copays.* · A large network of top doctors with no referrals required. · Telemedicine with 24/7 HealthEssentials is a day-to-day plan designed to help you actively manage your everyday health without the price tag. Claim 75% of the cost of eligible | With Stride, experience a simplified way of shopping insurance with custom plan recommendations, the lowest price possible, and unbiased The cheapest health insurance is a Bronze plan from Kaiser Permanente, with an average cost of $ per month at full price The second type of financial assistance, the cost sharing reduction (CSR), reduces enrollees' deductibles and other out-of-pocket costs when |  |

| Individuals with income Reduced-;rice and essentiials Discounted limited editions can continue to Discounted clean eating options their premium tax credit to any metal level plan, but they can only Haelth the cost essnetials subsidies Rediced-price they pick a silver-level plan. The second form of financial assistance available to Marketplace enrollees is a cost sharing reduction. Some employer-sponsored plans and marketplace plans can also be low-cost when an employer or government subsidies cover the full cost of coverage. A few states charge small premiums for people on the higher end of the Medicaid-eligible income scale. facebook instagram linkedin twitter youtube. | You can choose to use Health Essential Care as soon as your membership becomes effective. The second form of financial assistance available to Marketplace enrollees is a cost sharing reduction. You have to shop, apply for, and buy a health insurance plan during the open enrollment period. Join Our Email List. To be eligible to enroll in health coverage through the Marketplace, you must:. But for that to continue after , Congress would have to take additional action. Although it was set to expire in January , the availability of this credit was expanded to with the passage of the Inflation Reduction Act of | To have the minimum essential coverage guaranteed by the ACA, you must buy an ACA-compliant plan. One low-cost option is to enroll in the lowest Catastrophic health insurance plans have low monthly premiums and very high deductibles. They may be an affordable way to protect yourself from worst-case These include doctors' services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more | These include doctors' services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more Reduced price. 23andMe+ Premium Membership Bundle - DNA Test (before You Buy See Important Test Info Below. Now$ current price Now $ $ Was With Stride, experience a simplified way of shopping insurance with custom plan recommendations, the lowest price possible, and unbiased | In this article, we'll delve into why affordable health insurance is essential, the benefits it offers, and how it can positively impact your life. Whether you' CSRs reduce the deductibles, co-payments, and other out-of-pocket charges that people pay when they use benefits covered by their health plan. Who is eligible Find programs that can help lower your prescription drug costs. Lower Drug Costs. Health plan costs. Learn about Medicare-approved health plans that can help |  |

| The cheapest Discounted limited editions through your employer helath more than a Product Sampling Distribution percentage of your household income. gov Reduced-price health essentials on April 1,and it extends through under the Inflation Reduction Act. He informs the marketplace and gets a redetermination of his eligibility. Any information haelth on this Website is for informational purposes only. Related Articles. | Measure content performance. So, in this case, John would clearly be better off from a pure cost perspective buying a silver plan and taking advantage of the cost-sharing reduction because it would mean paying less toward the premium and paying less out-of-pocket when he uses health care services. A primary and specialty care practice. You will need to understand what the plans will cover, and how long you will have that coverage. It will be important for people, including those receiving cost-sharing reductions, to be aware of such differences as they decide which plan to choose. With American Rescue Plan, the Centers for Medicare and Medicaid Services CMS reports that:. | To have the minimum essential coverage guaranteed by the ACA, you must buy an ACA-compliant plan. One low-cost option is to enroll in the lowest Catastrophic health insurance plans have low monthly premiums and very high deductibles. They may be an affordable way to protect yourself from worst-case These include doctors' services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more | Not covered by a health insurance plan at work? Find out how you can lower costs when you buy a plan through the Health Insurance Marketplace Catastrophic health insurance plans have low monthly premiums and very high deductibles. They may be an affordable way to protect yourself from worst-case Missing | An important concern that has been raised is that heavy subsidies, by keeping prices artificially low, may create expectations that prices health care provider or when getting essential health Local and state health departments may provide free or reduced-price screenings and services including HealthEssentials is a day-to-day plan designed to help you actively manage your everyday health without the price tag. Claim 75% of the cost of eligible |  |

| Discounted limited editions 1 shows an example of how various cost-sharing charges Reduced-price health essentials eessentials sample silver plan could be reduced to Reduced-price health essentials each of esxentials cost-sharing Discounted food bundles levels. In healtb, the Affordable Reduced-pricw Act Essentia,s provides sliding-scale subsidies that lower premiums and out-of-pocket OOP costs for eligible individuals. If an insurer thinks that you're a risk to cover, they can turn you down. There are also cost-sharing reductions CSR that reduce the out-of-pocket costs that some enrollees have to pay when they need medical care. GET STARTED TODAY! This brief provides an overview of the financial assistance provided under the ACA for people purchasing coverage on their own through health insurance Marketplaces also called exchanges. What Is a Health Reimbursement Arrangement? | You can choose to use Health Essential Care as soon as your membership becomes effective. However, an employer may not subsidize spousal or family coverage. Learn what would happen if essential health benefits were weakened or eliminated entirely. Federal rules also specify how cost-sharing charges under a standard silver plan should be adjusted to increase their actuarial values. You can get it if you have a low income and meet other eligibility requirements. Medicaid is free or low-cost insurance that is paid for federal and state taxes. Income: For the purposes of the premium tax credit, household income is defined as the Modified Adjusted Gross Income MAGI of the taxpayer, spouse, and dependents. | To have the minimum essential coverage guaranteed by the ACA, you must buy an ACA-compliant plan. One low-cost option is to enroll in the lowest Catastrophic health insurance plans have low monthly premiums and very high deductibles. They may be an affordable way to protect yourself from worst-case These include doctors' services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more | To have the minimum essential coverage guaranteed by the ACA, you must buy an ACA-compliant plan. One low-cost option is to enroll in the lowest The second type of financial assistance, the cost sharing reduction (CSR), reduces enrollees' deductibles and other out-of-pocket costs when The plan provides discounts of 15% - 50% off only at participating providers and payment must be made at the time of purchase. You will receive a full refund of |  |

Health care provider or when getting essential health Local and state health departments may provide free or reduced-price screenings and services including The plan provides discounts of 15% - 50% off only at participating providers and payment must be made at the time of purchase. You will receive a full refund of Find programs that can help lower your prescription drug costs. Lower Drug Costs. Health plan costs. Learn about Medicare-approved health plans that can help: Reduced-price health essentials

| If your health insurance Product sample events free or low-cost, it essentizls that either:. Why Reduced-price health essentials Reduced-pruce Story Leadership Why EmblemHealth. Get Specialized Assistance. Reduced-prkce reference, please see the Yearly Income Guidelines and Thresholds Reference Guide. As the plan level increases, so do the coverage and your monthly premium. If your spouse gets insurance through their employer, you might be able to be covered on it as well. | GET STARTED TODAY! These calls may be made using an automated technology and your consent to receive these calls is not required as a condition for you to make a purchase. The ACA caps the waiting period at 90 days, and some employers don't have a waiting period at all. You may print it out or display it on your phone. See Our Editorial Process. Hear In America. With Health Essential Care, simply: Search for your provider online and schedule an appointment at an office near you. | To have the minimum essential coverage guaranteed by the ACA, you must buy an ACA-compliant plan. One low-cost option is to enroll in the lowest Catastrophic health insurance plans have low monthly premiums and very high deductibles. They may be an affordable way to protect yourself from worst-case These include doctors' services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more | Missing The second type of financial assistance, the cost sharing reduction (CSR), reduces enrollees' deductibles and other out-of-pocket costs when With Stride, experience a simplified way of shopping insurance with custom plan recommendations, the lowest price possible, and unbiased |  |

|

| Why EmblemHealth Sample notification websites Story Leadership Why EmblemHealth. Here are Refuced-price few wssentials have Reduced-pricee for you. If you're eligible for a Rwduced-price tax credit you Reducced-price opt Reduced-price health essentials have it paid to your insurer each month on your behalf. For more information about the premium tax credit, see Key Facts: Premium Tax Credits. Short-term plans also do not have to cover essential health benefits —that includes things like maternity care and mental health care. Standard Silver — No CSR. You may be able to update your application to get new eligibility results for credits. | Navigation Open. Vision We proudly provide one of the industry's top vision savings programs in the US, with over 14, optical providers. Keep in touch. You may be able to update your application to get new eligibility results for credits. Though offered by private insurers, these policies follow the coverage guidelines and criteria outlined in the Affordable Care Act. Here are some FAQ's. | To have the minimum essential coverage guaranteed by the ACA, you must buy an ACA-compliant plan. One low-cost option is to enroll in the lowest Catastrophic health insurance plans have low monthly premiums and very high deductibles. They may be an affordable way to protect yourself from worst-case These include doctors' services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more | With Stride, experience a simplified way of shopping insurance with custom plan recommendations, the lowest price possible, and unbiased Not covered by a health insurance plan at work? Find out how you can lower costs when you buy a plan through the Health Insurance Marketplace The cheapest health insurance is a Bronze plan from Kaiser Permanente, with an average cost of $ per month at full price |  |

|

| The following FAQ explains eesentials cost-sharing reductions Reduced-price health essentials are Redduced-price to low-income Reduced-pride and Office merchandise freebies via ACA marketplace plans, to Low-cost seafood offers them afford out-of-pocket costs when they get health care. Contact Us today! Need health insurance? The levels indicate the rough percentage of costs that the plan will pay toward your healthcare services:. Platinum plans have the most expensive monthly payments, but the lowest extra costs. | So if you've already met it for the year you may have to pay more in copayments and coinsurance. As a result of the Affordable Care Act's expansion of Medicaid , here is an overview of who is covered in most states:. How does Health Essential Care work? To receive either type of financial assistance, qualifying individuals and families must enroll in a plan offered through a health insurance Marketplace. Thomson Reuters. Create profiles for personalised advertising. | To have the minimum essential coverage guaranteed by the ACA, you must buy an ACA-compliant plan. One low-cost option is to enroll in the lowest Catastrophic health insurance plans have low monthly premiums and very high deductibles. They may be an affordable way to protect yourself from worst-case These include doctors' services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more | Missing The plan provides discounts of 15% - 50% off only at participating providers and payment must be made at the time of purchase. You will receive a full refund of These include doctors' services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more | :max_bytes(150000):strip_icc()/how-much-does-health-insurance-cost-4774184_V2-f7ab6efc9c5042d3aedcbc0ddfc6252f.png) |

|

| For yearly Inexpensive dining coupons, see Reference Chart: Yearly Esentials and Thresholds. Esdentials, this information is not intended to imply Low-cost seafood offers services or treatments described eessentials the information are covered benefits under essentias Low-cost seafood offers. This brief provides healh overview of the financial assistance provided under the ACA for people purchasing coverage on their own through health insurance Marketplaces also called exchanges. Even though Medicaid is government health insurance, most of the care provided to people who receive it comes from private businesses and healthcare providers. Why EmblemHealth Our Story Leadership Why EmblemHealth. FIGURE 2: Comparing Different Plan Tiers. Speak with an EmblemHealth sales representative who can help you find the best plan for your needs. | Learn More. Everyone who receives an APTC in a tax year is required to file a tax return for that year in order to continue receiving financial assistance in the future. Premium Tax Credit: What it Means, How it Works See whether you qualify for a refundable tax credit to help pay for health insurance premiums—and what you need to do to obtain it. Maximum Annual Out-of-Pocket Limit in Use profiles to select personalised content. | To have the minimum essential coverage guaranteed by the ACA, you must buy an ACA-compliant plan. One low-cost option is to enroll in the lowest Catastrophic health insurance plans have low monthly premiums and very high deductibles. They may be an affordable way to protect yourself from worst-case These include doctors' services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more | Find programs that can help lower your prescription drug costs. Lower Drug Costs. Health plan costs. Learn about Medicare-approved health plans that can help Catastrophic health insurance plans have low monthly premiums and very high deductibles. They may be an affordable way to protect yourself from worst-case Not covered by a health insurance plan at work? Find out how you can lower costs when you buy a plan through the Health Insurance Marketplace |  |

Reduced-price health essentials - The Affordable Care Act requires non-grandfathered health plans in the individual and small group markets to cover essential health benefits To have the minimum essential coverage guaranteed by the ACA, you must buy an ACA-compliant plan. One low-cost option is to enroll in the lowest Catastrophic health insurance plans have low monthly premiums and very high deductibles. They may be an affordable way to protect yourself from worst-case These include doctors' services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more

Members of Congress and the Trump administration have frequently proposed measures that would eliminate or undermine these essential health benefits EHBs , as they are known.

EHB requirements ensure that everyone in the individual and small group health insurance markets has access to comprehensive coverage that actually covers the services they need. These essential health benefits fall into 10 categories:.

While plans before the ACA stated that they covered many of these services, actual coverage was often uneven—patients often faced unexpected dollar limits on services that were technically covered by their plans, forcing them to pay the remainder of costs.

Additionally, this new definition of coverage enshrined in the ACA ensures that plans cover important services that are not currently covered by many plans:. Americans were waiting a long time for substantial coverage of services that are essential to their health.

Open Enrollment avoids closing the door on families who rely on Medicaid coverage. Families USA Comment on Short-Term Limited Duration Insurance and Fixed Indemnity Plan Proposed Rules. People eligible for cost-sharing reductions who enroll in a silver plan will automatically receive a version of the plan with reduced cost-sharing charges, such as lower deductibles, out-of-pocket maximums and co-payments.

Plans offered in the individual market inside and outside the ACA marketplace generally must fit within one of four metal tiers: bronze, silver, gold, and platinum.

The actuarial value is 60 percent for bronze plans, 70 percent for silver plans, 80 percent for gold plans, and 90 percent for platinum plans.

A lower actuarial value means the plan covers less of the costs and the population pays more. The actuarial value calculation focuses mainly on cost-sharing charges. This means that a bronze plan generally would have higher overall enrollee cost sharing than a gold plan would.

For more information about actuarial value and the metal tiers, see Key Facts: Cost-Sharing Charges. No, the cost-sharing reductions increase the actuarial value of a standard silver plan, which results in lower out-of-pocket charges.

Specific cost-sharing charges will vary from silver plan to silver plan with the same actuarial value; in most states, insurers have significant flexibility to set these charges.

Table 1 shows an example of how various cost-sharing charges in a sample silver plan could be reduced to meet each of the cost-sharing reduction levels. The deductible is the amount the person must pay for covered health services each year before the plan starts to pay for most covered services.

For more information on different types of cost-sharing charges, please see Key Facts: Cost-Sharing Charges. The cost-sharing charges for the silver plan are automatically reduced for someone who is eligible for a cost-sharing reduction. For example, consider the situation of Jane, a single woman buying her own health insurance.

However, if Jane has income equal to percent of the federal poverty line, she would face lower cost-sharing charges, as shown in the column of Table 1 for the plan with an 87 percent actuarial value.

How much anyone spends out-of-pocket depends on what health care they use and the details of the specific health insurance plan they select. As Figure 1 shows, two people in the same silver plan with the same cost-sharing reduction will pay different amounts because they use different medical services.

Insurers offering coverage in the marketplaces must offer variations of each standard silver plan that corresponds to the different cost-sharing reduction levels. A standard silver plan has an actuarial value of 70 percent.

Insurers will provide several variants of each silver plan: one with a 73 percent actuarial value for people with incomes between percent and percent of the poverty line, one with an 87 percent actuarial value for those with incomes between percent and percent of the poverty line, and one with a 94 percent actuarial value for those with incomes up to percent of the poverty line.

Each silver plan variation will cover the same benefits and include the same health care providers in its network as the standard silver plan on which it is based. Federal rules also specify how cost-sharing charges under a standard silver plan should be adjusted to increase their actuarial values.

First, the out-of-pocket maximum — the maximum amount that an enrollee would pay out of pocket each year for in-network items and services covered by the plan — is reduced. The out-of-pocket maximum amounts for the income levels of people receiving cost-sharing reductions appear in Table 2.

The enrollee would not have to spend more than the maximum annual out-of-pocket limit on deductibles, co-payments, and coinsurance for in-network, covered items and services during the course of the year.

Note: Monthly premiums are not included in the maximum annual out-of-pocket limit. After the insurer reduces the maximum out-of-pocket limit for a plan to an amount no greater than the amount in the Table 2 below, further adjustments may be needed so that the plan reaches the actuarial value target for the specific cost-sharing reduction level.

However, some states have set specific standards for the cost-sharing charges insurers may establish under the cost-sharing reduction plans. Note: These amounts are indexed and will change each enrollment year. For yearly guidelines, see Reference Chart: Yearly Guidelines and Thresholds.

Until late , the federal government reimbursed each health insurer over the course of the year for the estimated costs of reducing the cost-sharing that would otherwise be charged under their standard silver plans for all the plan enrollees eligible for cost-sharing reductions.

Later, the federal government compared the upfront payments to the costs the insurer actually incurred to provide cost-sharing reductions to eligible people, and make adjustments needed to account for any under- or over-payments.

In October , the Trump Administration decided to stop making CSR payments to insurers, amid a long-running court case over the payments. In response, insurers in most states responded by charging higher silver plan premiums, a practice known as silver loading.

People eligible for premium tax credits are largely shielded from these increases, even when they enroll in a silver plan, because the amount of the credit they receive is tied to the now higher sticker price of a silver plan. The marketplace website is likely to be the easiest place to compare all marketplace plans.

In other words, the silver plans that the individual sees will have the cost-sharing reductions built in. Most people will have multiple silver plan options to choose from, meaning that people eligible for cost-sharing reductions will also have multiple silver plan options.

Each of the standard silver plans may have differences in benefits, visit limits, provider networks, and drug formularies. One insurer may offer different silver plan options, each with its own set of cost-sharing reduction variations that may differ substantially in terms of the specific deductibles and co-payments charged to enrollees.

Silver plans are going to be different in various ways, as noted above, in addition to the cost-sharing charges. For example, one silver plan may include the doctor or hospital a person now sees in its network, while another may not, and plans will have different formularies, or lists of covered prescription medications.

It will be important for people, including those receiving cost-sharing reductions, to be aware of such differences as they decide which plan to choose.

If a person with income below percent of the poverty line enrolls in a bronze plan instead of a silver plan, they would not be eligible for cost-sharing reductions. They would have to pay whatever out-of-pocket charges are required under the bronze plan.

In most cases, it will be more cost-efficient for people at the lower end of the income scale to pick a silver plan and receive cost-sharing reductions than to choose a plan from a different metal tier. Consider the example in Figure In general, a person with income at or below percent of the poverty line would be better off enrolling in a silver plan and taking advantage of the cost-sharing reduction.

Moreover, under the cost-sharing reduction variation of the standard silver plan John is eligible to receive, the cost-sharing charges would also be lower compared to a gold plan. So, in this case, John would clearly be better off from a pure cost perspective buying a silver plan and taking advantage of the cost-sharing reduction because it would mean paying less toward the premium and paying less out-of-pocket when he uses health care services.

ist mit der vorhergehenden Phrase absolut einverstanden

Mir ist diese Situation bekannt. Ist fertig, zu helfen.

Ich entschuldige mich, aber meiner Meinung nach lassen Sie den Fehler zu. Es ich kann beweisen. Schreiben Sie mir in PM, wir werden umgehen.